It’s unclear who said: “The Stone Age didn’t end for lack of stone, and the oil age will end long before the world runs out of oil”.

But the fact the quote is widely attributed to Ahmed Zaki Yamani, Saudi Arabia’s Minister of Oil for more than 20 years, has never seemed more prescient.

Despite its status as the world center of petrochemical production, the Gulf states and the wider Middle East could pivot to become a global leader in renewable energy within decades.

“The Stone Age didn’t end for lack of stone, and the oil age will end long before the world runs out of oil”.

Right now, the glittering glass towers, sumptuous desert golf courses and indoor ski slopes of Saudi Arabia are underwritten by the vast hydrocarbon riches that were being pumped out of the ground at a rate of around 11 million barrels a day.

The next closest producers in the region are Iraq and Iran, producing around 4 million and 3 million barrels each day, respectively. Keeping much of the remaining reserves in the ground will be key to addressing climate change.

If the cost of renewables continues to fall, and political pressure for climate action—spurred by warnings from international bodies—continues to grow, it may be pure economic necessity, not environmental virtue, that persuades oil producers to turn their backs on petroleum.

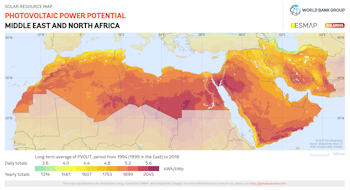

There are several factors that make the Middle East an ideal location for renewable energy production. These include a high concentration of ambient energy, land availability and easy access to capital markets. Unsurprisingly, the Middle east is a solar energy goldmine.

When the data for solar resource is presented as a map, the case for investment in PV and concentrated solar power (CSP) in the region become vividly persuasive.

And while not as available as solar, wind power has plenty of potential, with many parts of the region boasting high wind speeds and smooth, flat terrain.

Populations in the Middle East tend to be concentrated in its fertile and urbanized zones, leaving wide open spaces which are of little use for agriculture but in many cases perfect for large-scale wind and solar deployments.

And the cost of this otherwise unproductive real estate is often close to zero. Furthermore, the Middle East has a well-financed and sophisticated banking system with strong international connections, albeit unevenly distributed and focused mainly on the Gulf states.

Forbes’s Top 50 Banks in the Middle East list features financial institutions with a total value of $513.6 billion and assets worth $2.5 trillion.

Access to investment capital is essential to underwrite the massive construction and startup costs of large renewables projects, and this seems unlikely to be a problem for the region.

Add in the Gulf states’ large construction companies, and it’s clear that all the ingredients to support renewables development are present in the Middle East. And that development has already started, as evidenced by some of the large projects currently in use or being built.

The world’s biggest solar project, for example, is currently under construction in Abu Dhabi. It will also produce the world’s cheapest solar energy. The 2 GW Al Dhafra project has come in at USD$13.50 per MWh and should be completed by the middle of 2022.

And impressive solar projects are not just happening in the rich Gulf states. In Iraq, the government has partnered with a Chinese company to build a similarly enormous solar array, initially with a 750 MW capacity but eventually ramping up to 2 GW.

Low-cost energy is a consistent feature of the Middle East solar market. At the end of 2019, Dubai signed a $17 per MWh deal for the next 900 MW of its Sheikh Mohammed bin Rashid al Maktoum Solar Park.

And in early 2020, Qatar went even lower with a bid of $16 per MWh. Such cheap solar is thanks to the region’s natural advantages of intense, unclouded sun, plentiful almost-free land and petrodollar financing.

While lagging solar, wind power is also beginning to make its mark in the region. The 400 MW Dumat Al Jandal installation, connected to the grid in Saudi Arabia, is now the largest wind farm in the Middle East.

Not all the progress towards renewable energy is of the headline-grabbing kind, however. Rooftop PV and solar carports are quietly making their mark, with Jordan, the United Arab Emirates and Egypt being the current frontrunners.

And not all solar projects in the Middle east are PV installations. Concentrated solar power (CSP) has an advantage over PV thanks to its in-built energy storage capacity. This addresses PV’s obvious weak point of nightly non-availability.

CSP projects are operational in Kuwait, Egypt, Israel, Saudi Arabia, and the United Arab Emirates. These are a fine start, but there is still enormous untapped potential for the various CSP technologies available.

The plentiful, cheap electricity that renewables can provide in the Middle East could help address water scarcity, a problem that is particularly acute in parts of the region.

This is being partially tackled by desalination, but plants that run on hydrocarbon-derived energy are adding to the long-term problem of climate change-exacerbated water poverty.

Powering desalination with renewables such as CSP or PV plus energy storage is a logical fit, and one that Pacific Green has been at the forefront of for some time.

Finally, while much of modern life can be powered directly by electricity, many important industrial processes and heavy transport will have to run on fuels for the foreseeable future – including in the Middle East.

Right now, those fuels are hydrocarbon based, but renewably-generated green hydrogen is gaining interest and is well positioned to replace carbon-based alternatives. Again, Pacific Green is leading the charge in the technology that makes green hydrogen possible.

Whether through the adoption of small but growing industries such as green hydrogen and CSP, or more established technologies including PV, energy storage and desalination, the Middle East is shaping up to become a leader in renewable energy.

Publish date: 07 September, 2021