This is hydrogen’s big year. The universe’s most common molecule is rapidly becoming the world’s most popular choice of low-carbon fuel and feedstock. And there is one hue of this colorless gas that is getting most of the attention.

Green hydrogen, which is so called because it is made via electrolysis of water using only renewable energy-based electricity, is too expensive for most commercial applications today but is expected to see rapid growth in scale and reductions in cost.

According to the research and consulting company Delta-EE, this year could be a tipping point for green hydrogen viability as 115 projects with a combined electrolyzer capacity of more than 2.1 GW are due to enter operation over the next 24 months in the UK and Europe alone.

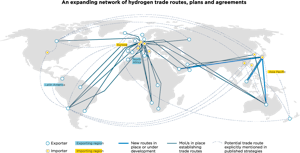

The use of green hydrogen as a substitute for fossil fuels could have profound impacts on geopolitical relationships that have traditionally been built on energy trading.

The use of green hydrogen as a substitute for fossil fuels could have profound impacts on geopolitical relationships that have traditionally been built on energy trading.

“Hydrogen trade and investment flows will spawn new patterns of interdependence and bring shifts in bilateral relations,” says the International Renewable Energy Agency (IRENA).

“Countries with an abundance of low-cost renewable power could become producers of green hydrogen, with commensurate geo-economic and geopolitical consequences.”

Which nations are best positioned to take advantage of this geopolitical shift? As IRENA states, the availability of abundant, low-cost renewable energy is a key factor. But it isn’t the only one.

Hydrogen is not easy to move around cost effectively, so in the early stages of market development it will be important to be able to produce the gas close to places where it can be used.

This has led experts to predict that green hydrogen will initially be produced in industrial clusters where it only needs to be piped a short distance to where it is needed, for instance for steelmaking or ammonia production.

Industrial clusters, in turn, tend to be found in relatively rich countries with large, stable economies. And if a nation is actively supporting the development of green hydrogen production, so much the better.

Based on these assumptions, it is possible to get an idea of places where green hydrogen production might take off first—and which countries could become leaders in the hydrogen economy of tomorrow.

On top of that, some countries are already jostling for pole position in this market. In November 2021, IRENA listed 17 prospective green hydrogen exporters that had already signed bilateral agreements and memorandums of understanding to potential importers.

Based on the current state of play, here are 13 countries that we at Pacific Green are among the best placed to lead in green hydrogen production over the coming years. Let us know if you think we have missed any.

Australia

Australia’s top exports today include coal and gas, but lawmakers are aware these fuels are falling from favor abroad. With abundant solar and wind resource, green hydrogen looks like a good replacement—although it may need to be turned into ammonia for export purposes.

Canada

Canada and the US both have significant green hydrogen production potential. But the US’s high energy and feedstock demands may leave it needing to import the gas, while Canada, with abundant hydro and nuclear supplies, could well become an export leader

Chile

Chile has Latin America’s most advanced clean energy market and lowest cost of renewables, making it the region’s natural leader for green hydrogen. At Pacific Green we’ve already shown how this could be turned into ammonia costing under $400 a ton.

China

A country with which Pacific Green has strong trade links, China is looking to lead in many aspects of the energy transition. Its commitment to green hydrogen looks sure to deliver results, although the split between exports and local consumption remains to be seen.

France

France’s uniquely nuclear-heavy electricity mix is a challenge in energy transition terms because nukes do not adapt well to the intermittency of renewables. But using spare energy to produce hydrogen could be a win-win for the grid and for France’s energy export potential.

Germany

Europe’s richest nation has made no secret of its hydrogen ambitions. It is relying on hydrogen to replace large parts of the energy mix currently served by coal, natural gas and nuclear. Production could be powered by excess wind power, which is often curtailed or exported now.

Japan

Japan has been pursuing the idea of a hydrogen economy longer than any other nation. However, national production capacity may be limited by available renewable resources. The country is usually viewed as likely to be a net hydrogen importer rather than exporter.

Morocco

The top African nation in EY’s Renewable Energy Country Attractiveness Index, Morocco has vast solar resources it can devote to green hydrogen production—and a raft of soon-to-be hydrogen-hungry demand centers just across the Mediterranean sea.

The Netherlands

The Dutch government published a hydrogen strategy in March 2021 outlining plans to use excess power from around 70 GW of offshore wind generation to drive electrolysis. The country is well placed to develop industrial clusters around its ports.

Saudi Arabia

Historically the world’s biggest oil exporter, Saudi Arabia knows the value of leading in energy markets—and is unlikely to miss out on the green hydrogen opportunity. It also has the renewable resources and investment muscle to achieve early leadership.

South Africa

Resource-wise, many sub-Saharan African nations have the potential to develop green hydrogen. But South Africa tops our list because it has the most highly developed renewables market and greatest industrial strength. IRENA sees it ultimately supplying European markets.

Spain

Spain’s booming renewables market could deliver a third of Europe’s green hydrogen by 2024, and Spanish companies such as Iberdrola are already setting the pace in terms of installed electrolyzer capacity. Getting green hydrogen to the rest of Europe may be tricky, though.

United Kingdom

The UK’s leading offshore wind fleet could be perfectly positioned to deliver green hydrogen and the government is fully committed to developing industrial clusters around the gas. One uncertainty is the extent to which gas-based blue hydrogen might prevail, though.

Publish date: 22 February, 2022