February’s UK T-1 auction results brought plenty of cheer for energy storage investors, with increases in the amount of battery capacity winning the contest.

The auction has become a key date for UK energy storage watchers, since it is one of two annual planning events that determine the amount of spare capacity National Grid ESO, which manages the electricity network, will pay for to help meet fluctuations in demand.

The T-1 auction is to fine tune the capacity that will be needed in the next financial year, so for the fiscal period running from April 6, 2023, to April 5, 2024. A separate auction, T-4, ensures the bulk of spare capacity needed for the system is procured four years in advance.

The capacity markets were introduced in 2014 as part of the UK’s Electricity Market Reform, which aimed to keep the lights on as the country transitions from a carbon-intensive electricity system based on thermal plants to a low-carbon one based on intermittent renewables.

Under the old system, there was no need for spare capacity. If demand went up, you could just increase the output of nuclear, coal and gas plants. But as these plants are being retired, the system needs something in reserve for when the UK’s wind farms and solar parks are not producing energy.

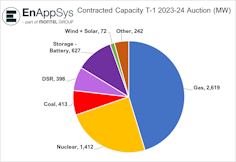

That something can take many forms. For the time being, there is still a fair amount of thermal generation around that can be called upon if needed. Hence, February’s T-1 auction was dominated by gas, which took 45% of the capacity awarded, followed by nuclear at 24%.

But the third largest winner was battery storage, picking up almost 11% of the capacity on offer. This marked a significant improvement in the battery sector’s performance in T-1 auctions, according to EnAppSys, an electricity market data provider.

“There has been a substantial increase in new-build battery capacity in the auction, with more than twice as much winning contracts as last year,” it said. “Of the new-build capacity than won contracts, 54% (568 MW) was from batteries against just 15% (261 MW) last year.”

Not only has the amount of battery capacity in the T-1 auction grown, but so too has the size of the overall pie.

The 5.8 GW under the hammer was the largest amount ever in a T-1 auction, although this figure could grow further in future as an increased proportion of variable renewables on the grid forces the system operator to have more spare capacity on hand.

Furthermore, said EnAppSys, “Such a high target capacity indicates that National Grid ESO is seeking to place further emphasis on domestic solutions to energy supply issues, something it demonstrated this winter with the winter contingency contracts that kept coal units in reserve.”

Pricewise, auction bidders did not fare quite as well as last year, when energy security concerns drove bidding right up to the T-1 ceiling of £75 per kilowatt of capacity per year.

Nevertheless, this year’s clearing price, settled after three rounds of bidding, ended at a very respectable £60 per kilowatt per year, “improving the financial prospects of many new-build assets as well as continuing the lifespan of some units that were at risk of retirement,” EnAppSys said.

“Due to the extreme market conditions seen in the last 18 months, and with National Grid ESO paying a premium for coal capacity under the winter contingency contracts, capacity is far more highly valued than when the T-4 auction for the 2023-24 delivery year took place,” it said.

“That auction cleared at £15.97/kW/year, around one quarter of the clearing price of this year’s T-1 auction, meaning that units that won a contract in this auction will receive approximately four times the payment for their capacity as units who won contracts in the T-4 for the same delivery year.”

Furthermore, the outlook for battery storage in the UK’s capacity markets could not be brighter. Corby 1 and Medway, two of the largest gas power plants to win capacity in this year’s T-1, are likely to retire once their auction contracts expire next year.

And Ratcliffe-on-Soar, the only coal plant to win a contract in the auction, is also set to close in 2024. Longer term, all but one of Britain’s nuclear power plants are scheduled to cease operating by 2030.

This means that over what remains of the decade practically all the thermal generation that took almost 77% of the capacity in this T-1 will be retired.

Some of that lost capacity may be replaced by energy imports via interconnectors to Europe, although as EnAppSys points out the current thinking at National Grid ESO is that domestic assets should be used where possible.

A growing chunk of spare capacity could also be sourced through demand-side response programmes, which is where energy consumers get paid to turn down their electricity consumption when supply cannot match demand.

Over time, there is an expectation that some of the UK’s remaining natural gas plants may be converted to run off hydrogen. But even under the most optimistic scenarios, widespread use of hydrogen for energy storage is unlikely to take place until sometime in the next decade.

That means for years to come the UK’s capacity markets will largely be for the taking by battery developers. The fact that batteries had the fastest-growing share of capacity in this year’s T-1 is no mistake—and is likely to be the trend going forward.

Most importantly for investors, though, is the fact that the T-1 is just one of many markets that a UK battery system can make money from.

Currently there are at least six grid markets that batteries can operate in, covering wholesale, balancing, ancillary services, time-of-use, stabilisation and infrastructure.

This diversity of potential revenue streams means projects such as the Richborough and Sheaf energy parks being developed by Pacific Green are almost sure-fire money makers. And with augmentation, these assets could have a lifetime of more than 30 years.

Publish date: 10 March, 2023